Market Making for Decentralized Finance: How H20 Brings Liquidity Onchain

Unlocking efficient markets through non-custodial adaptive Liquidity.

TL;DR

H20 delivers 100% DeFi-native market-making and trading strategies, enabling projects to take complete control of their token liquidity. With dynamic onchain limit orders that execute perpetually, customizable strategies act like mini DEXes with their own curves. Tokens always remain under your control—only your project's wallet can deploy, modify, or withdraw strategies.

- Tailored strategies for token launches, treasury management, peg management, and low-volume revival.

- Revenue-generating solutions driving liquidity from CEXes to DEXes.

- Profitable spreads and 100% of profits directly in your wallet.

- Complete self-custody, eliminating third-party risk, latency, slippage, gas, and MEV.

- Fully transparent, verified strategies that build trust and legitimacy.

Includes:

- Dedicated account manager, strategy design, execution, and insights on tokenomics.

With no bots, coding, or infrastructure required, H20 ensures efficient, secure, and transparent liquidity management to grow your project sustainably.

Explore H20’s Strategies:

Dive into the Docs | Partner with H20

H20 - Unlocking Your Onchain Liquidity

Until now, it has been difficult to profitably make markets onchain in a cost-effective, frictionless way that lives up to blockchain's permissionless, decentralized, verified, transparent, self-custody ideals.

Third-party market-makers take control of your assets, charge high fees, and are unwilling to transparently verify the executed trade data using a decentralized, onchain, permissionless method. It is in their interest to keep you in the dark. Working with CEXs means surrendering custody of your token, accepting counter-party risk and relying on centralized liquidity. Liquidity provision on DEXes for AMMs exposes you to impermanent loss, and very little trade automation is available. Bot trading means handing over your private keys, paying for infrastructure, and entertaining potentially high gas costs at critical times of extreme volatility, along with MEV front running and sandwich attacks from transaction reordering.

So, how can you access professional-grade market-making algorithms without handing over your tokens or private keys to your wallet?

After 4 years of working on how to solve these problems, we have launched H20, the first provider of DeFi-native, 100% onchain, self-custody, transparent, verified, market-making, and custom trading strategies, open to anyone to grow profitable onchain liquidity for crypto projects, their token and communities.

H20 completely transforms how projects manage tokens onchain from the ground up. By leveraging self-custody smart contracts that contain customizable automated perpetual algorithmic strategies deployed from the user's wallet using our open-source programming language (Rainlang), H20 enables users to optimize trading, reduce volatility, and maintain control of their funds.

Let's explore how H20 provides authentic DeFi market-making.

The H20 Edge: Dynamic Onchain Market-making

H20 bridges the gap between traditional market-making practices and the decentralized ethos of blockchain technology. Its innovative features solve key challenges in onchain liquidity management:

- Self-Custody: Unlike centralized exchanges (CEXes), third-party market makers, or bot-based DEX trading, H20 ensures self-custody of your tokens at all times. Only the project's wallet can modify or withdraw tokens, eliminating the risks of handing over private keys and compromising the control and security of your assets.

- Efficiency Without Infrastructure: H20 removes the need for complex infrastructure. Once deployed, the smart contract executes the strategy perpetually as long as the user requires. A permissionless network of solvers automatically clears trades against DEXes, streamlining and decoupling operations while safeguarding assets.

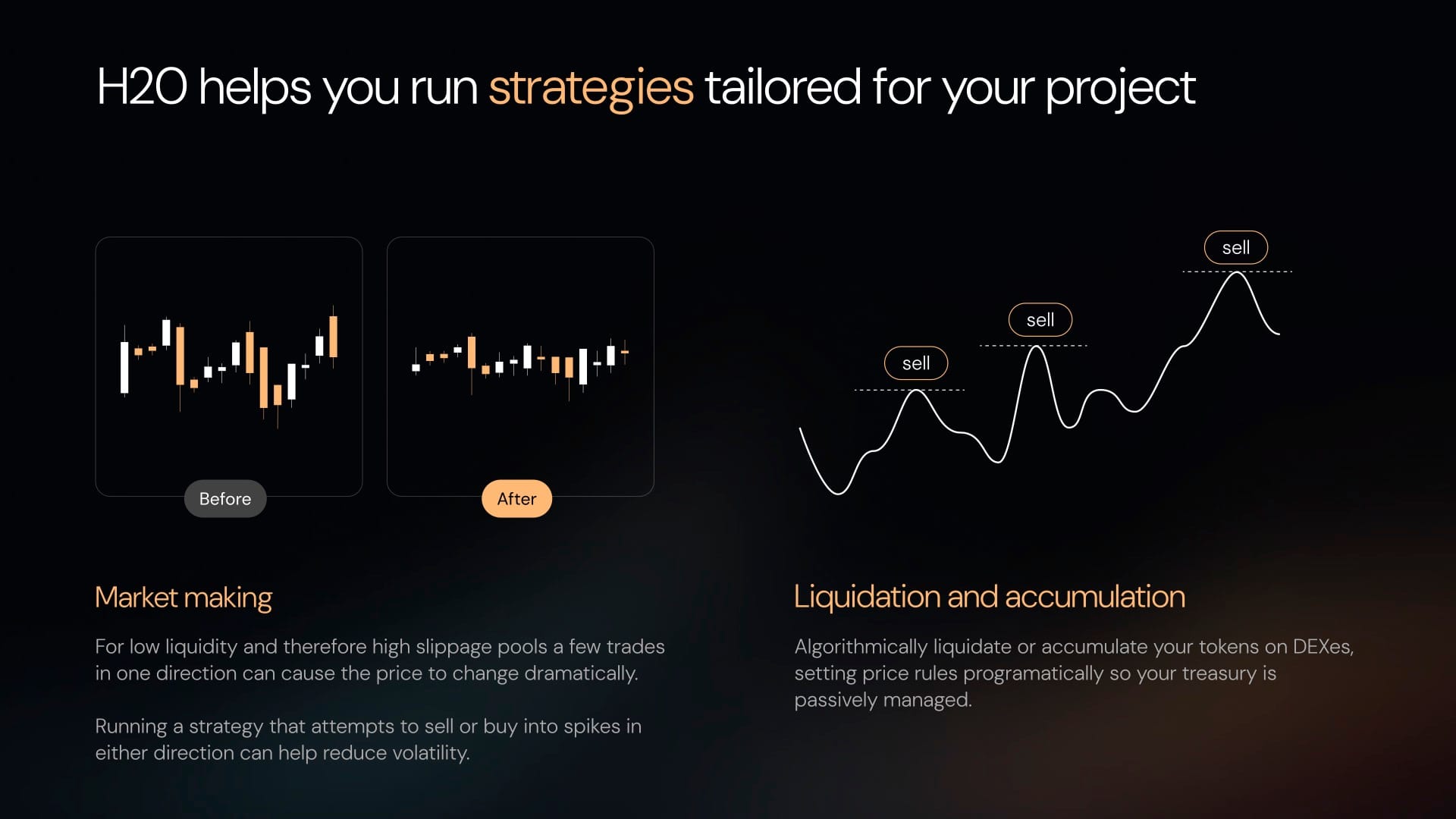

- Tailored Strategies: H20 offers a suite of customizable strategies to suit various project goals, including:

- Auction-Based Dollar-Cost Averaging (DCA): Automatically executes trades at optimal prices, leveraging dynamic auction pricing to minimize market impact.

- Grid Trading: A smart sell automation strategy that captures value while maintaining price stability through sequential and shy liquidity orders.

- Dynamic Spread Management: Ensures profitable market making by dynamically adjusting spreads based on market conditions and tracking cost basis.

- Goal-oriented: H20’s strategies are ideal for specific trading purposes.

- Peg Management: Ideal for stablecoins and real-world asset issuers, maintaining pegs through oracle data and arbitrage strategies.

- Buyback: Stabilizes prices during dumps by deploying liquidity through premium starting prices and rapid decay curves, creating predictable buy pressure and efficient auction-based price discovery.

- liquidations: Ensures price stability by systematically selling assets through discounted starting prices and steady decay curves, creating predictable selling pressure and efficient liquidity distribution without market crashes.

- Swing Trading: captures price swings with alternating buy and sell auctions, using dynamic spreads and exponential decay curves for controlled, systematic entries and exits.

- Treasury Management: Automates liquidation and accumulation processes, allowing treasuries to manage tokens programmatically.

How It Works: Elegant Simplicity

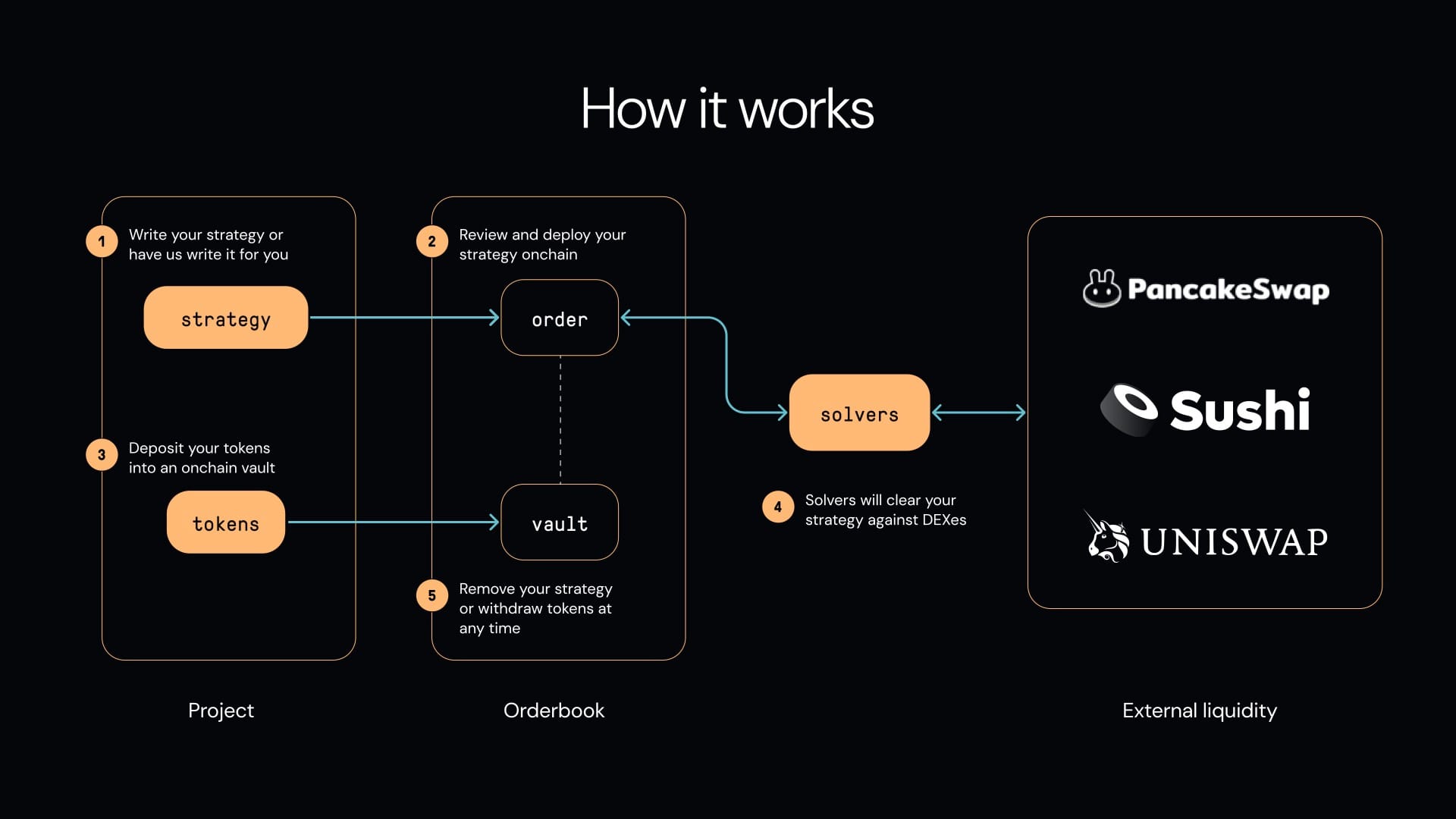

H20's streamlined approach involves just a few key steps:

- Define Strategy: Write a custom strategy or let H20's experts create one tailored to your project.

- Deploy Onchain: Review and deploy the strategy directly on the blockchain.

- Deposit Tokens: Securely transfer tokens into an onchain vault.

- Automated Execution: H20's solvers continuously execute the strategy, providing liquidity and stability.

- Retain Control: Remove strategies and withdraw tokens at will.

Why Choose H20?

H20 stands out with its verified commitment to transparency, decentralization, efficiency, and user control at cost-effective prices. Here's why projects trust H20:

- Immutable: Complete top-to-bottom self-custody solution. Receive 100% of all profits directly into your wallet immediately.

- Specialization: With H20, you get tailored strategies for your specific goals. Get a bespoke design for token launches, treasury management, accumulations, liquidations, and buyback objectives.

- Capital Efficiency: Maximize the utility of your capital through strategies designed for optimal token execution and minimal slippage.

- Flexibility and Automation: Enjoy the benefits of custom strategies operating 24/7 without needing manual intervention or additional infrastructure.

- Risk Management: H20 minimizes operational risks by offering a fully onchain, self-custody solution with no private key exposure, infrastructure requirements, or opaque processes, while ensuring transparency.

- Healthier Markets: By reducing price disagreements and creating stability, H20 enhances the trading environment for all participants.

- Verified and Transparent: Feel at ease knowing there is no way we can fake reporting figures.

Transforming DeFi, One Strategy at a Time

H20 is more than just a platform; it's a comprehensive solution for projects aiming to thrive in the decentralized economy. Whether you're looking to optimize liquidity, stabilize token prices, or automate treasury operations, H20 empowers you with the tools and confidence to succeed.

Ready to revolutionize your project's liquidity management? Visit H20.finance to learn more and explore the possibilities.

Get in touch.